Part I: 1099's

What: Form 1099 is a federal tax form used to report miscellaneous income to the IRS for those that do work for the association. Many associations pay independent contractors and other unincorporated entities for work throughout the year. Form 1096 is a summary of the 1099’s filed by the association and is provided to the IRS. Read more about Form 1099 here.

Who: 1099’s are required by the IRS.

When: 1099’s must be issued when the association pays over $600 to an independent contractor or other unincorporated entity. They must be mailed by January 31st of the following tax year (i.e. 2017 payments must be reported by January 31, 2018).

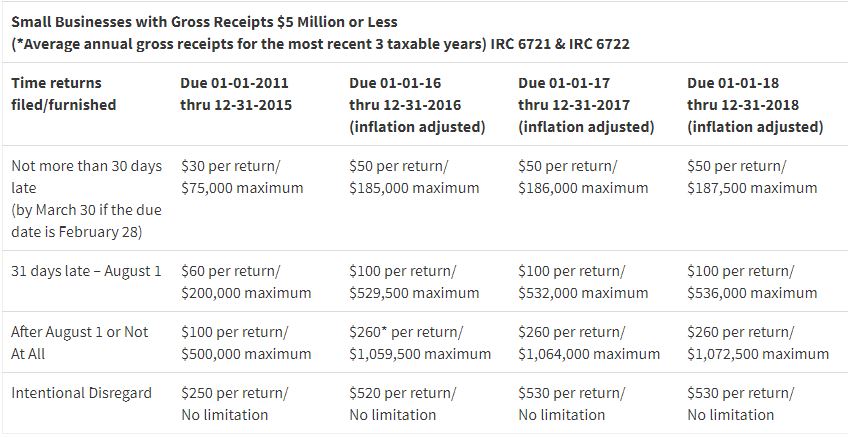

Why: Accurate and timely filing of 1099’s ensures the association will avoid penalties. The penalty rates range from $50-$530 per form. For more details, click here.

How: All payments that the association has made for the calendar year are summarized by our accounting department and 1099’s are issued to all vendors that meet the federal requirements. We have controls in place to ensure we obtain all pertinent tax information from the association’s vendors to make sure the 1099 filings are as accurate as possible.

Part II: DE 542's

What: Form DE 542 is a report of independent contractors. The association is required to report independent contractor information when it hires an independent contractor and the following statements apply:

- The association is required to file a Form 1099-MISC for the services performed by the independent contractor (see Part I: 1099’s).

- The association pays the independent contractor $600 or more or enter into a contract for $600 or more.

- The independent contractor is an individual or sole proprietorship.

Read more at the EDD website, here.

Who: DE 542’s are required by the California Employment Development Department (EDD).

When: A DE 542 must be filed within 20 days of either making payments of $600 or more or entering into a contract for $600 or more with an independent contractor in any calendar year, whichever is earlier.

Why: The information reported on a DE 542 is used to assist state and county agencies in locating parents who are delinquent in the child support obligations. Accurate and timely filing of the DE 542’s ensures the association will avoid facing penalties. The association may be charged a penalty of $24-$490 for each failure to report within the required time frames.

How: When a new vendor is entered into our software, we determine if these filing requirements will apply to them. Once any qualifying vendors reach payments of $600 or more, our accounting department generates and files a DE 542 for that vendor.